Alternative Insight

Optimizing the Federal Corporate Tax Rate

The Trump administration and its lower tax advocates have not provided adequate analyses and proofs to validate their opinions. Proponents of lower corporate taxes, who claim it will make corporations more productive and escalate production activity, may find their proposals do not automatically make corporations more competitive and benefit the economy less than equivalent Government spending. Rather than catering to corporate sponsors, the administration should ascertain the optimum corporate tax and propose a tax rate that most advances the economy for the benefit of all Americans.Three posed advantages in lowering corporate tax rate:

(1) Increased funds for investment translates into increased production, increased employment, and increased Gross Domestic Product (GDP).

(2) Increased after tax profits allow corporations to improve competitiveness by additional spending on research and development, marketing, productivity incentives, and use of other measures, such as lowering prices and rewarding workers.

(3) High tax rates drive corporations to nations that have low tax rates and punish workers in the high tax nation.Start with some facts.

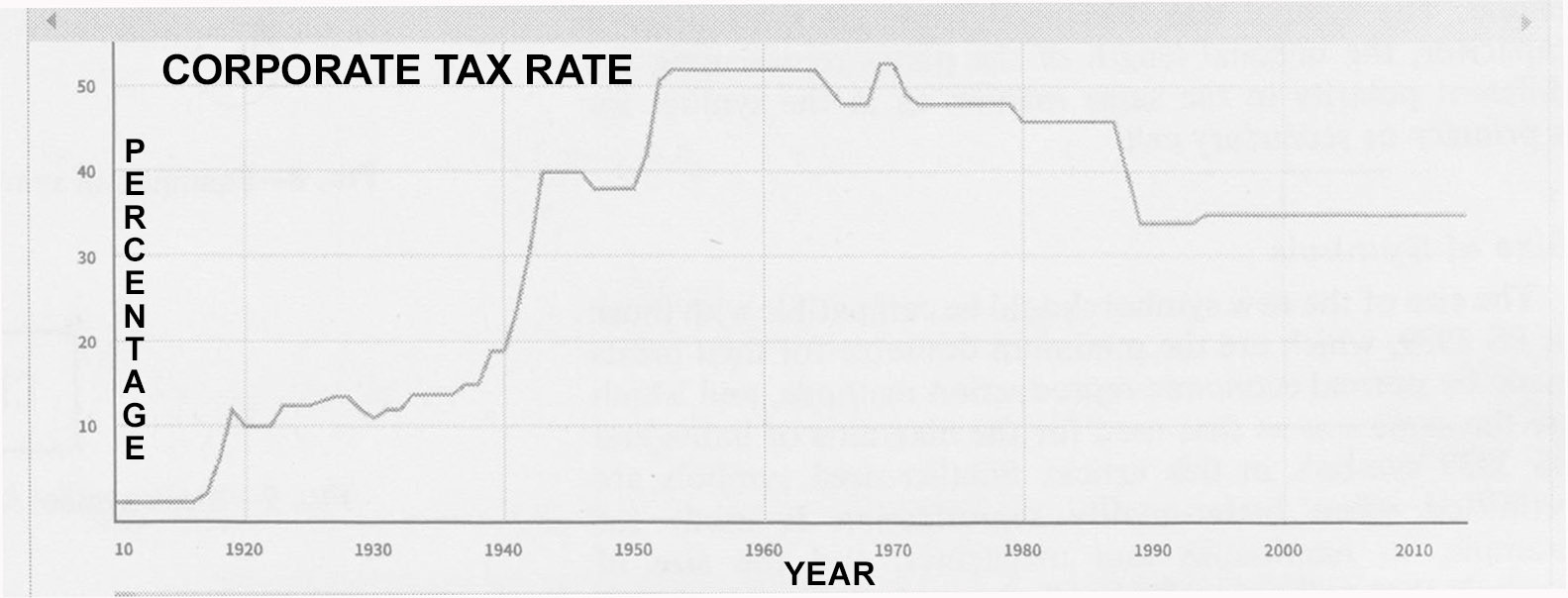

The following graph shows that the maximum corporate tax rate, 35 percent for income greater then $18.3 million, has been much higher in previous decades, and the nation has prospered. The rate has been relatively constant for the last 32 years, and the economic gyrations have not shown to be due to that rate.

The other graph tells a partial story -- corporations have taken advantage of tax breaks and loopholes to reduce their taxes. The major problem is not high corporate tax; the major problem is the ability of many corporations to avoid paying taxes. If tax breaks and loopholes unique to U.S. corporations, such as accelerated depreciation, using excess tax benefits from stock options to reduce federal and state taxes, and industry specific tax breaks were reduced or eliminated, then the tax rate could also be reduced; the government charges with one legislation and discharges with another legislation. Corporations are responsible for finding loopholes to avoid taxes, but the government is responsible for providing the loopholes. Those paying no tax are not complaining; those paying a 20 percent tax might register slight complaints, and those paying more than 20 percent deserve to complain, not about their high tax rate, but to the corporations that manage to pay little tax and to the government for not minimizing the tax breaks and for not closing loopholes.With those thoughts as an introduction, examine the posed advantages of lowering the corporate tax.

Increased funds for investment translate into increased production, increased employment, and increased Gross Domestic Product.

These are true if corporations used the greater part of their profit for increased investment. However, they use much of the profit for executive bonuses, stock buybacks, corporate takeovers, and to retain earnings.Goldman Sachs estimates that S&P 500 companies will spend $780 billion on stock buybacks in 2017, a part being driven by repatriated profits. In 2004, Congress enacted a one-year repatriation tax holiday that lowered to 5.25 percent the rate that corporations would pay to return deferred foreign income and expected the repatriated funds would increase employment and investment in the U.S. economy. The Center for American Progress at https://www.americanprogress.org/issues/economy/reports/2014/01/09/81681/offshore-corporate-profits-the-only-thing-trapped-is-tax-revenue/ claims, "Economic researchers found that the tax holiday had no effect on employment or investment. In the end, corporations that repatriated profits just used that money for dividends and other payouts to investors."

One reason for corporate taxes is to do for the corporate world what income taxes do for the public -- redistribute the wealth from those who have to those who need. By taxing corporations, the federal government takes surplus profits from corporations and, directly or indirectly, purchases goods that allow other corporations to be profitable. Go through the numbers and, over sufficient time of tax and spend, the original taxed profits reappear in the system. Because sufficient purchasing power to purchase all the goods and services in the economy never exists, and credit, which grows and grows and grows, is necessary to alleviate the shortfall, the corporate tax alleviates the shortfall without introducing additional credit.Left out of the corporate books is responsibility to support infrastructure - transportation, communication, utilities - government research, government loans, credit guarantees, bailouts, assistance to education, job training, subsidies, and other programs that benefit corporations. Shouldn't corporations repay a fair share of the financial assistance that guarantees their prosperity?

.

Cut to the chase.

Observe corporation after tax profits during the last decades - companies have expanded and their profits have steadily increased; therefore, sufficient funds for investment must have been available.

Corporation taxes contribute about 10 percent to federal government revenues. Seems like too much? During the 1950s, corporation taxes accounted for 30 percent of total federal revenues.

With increased after tax profits, corporations can improve competition by increasing marketing expenditures, productivity incentives and by use of other measures, such as trading the profits for lower prices and rewarding workers.

Basic flaws:

(1) For internal competition, all companies will receive the same advantages, and the advantages will be canceled.

(2) Competing with foreign products means competing with wages and productivity. Prices are magnitudes more dependent on these factors than trading profits for lower prices.

(3) How much can the prices be lowered? Calculations, shown in the following table, demonstrate what products will cost for two different profit margins with a reduction of the corporate tax from 35 percent to 15 percent, and if the corporation forfeited all of the profit increase by reducing its prices.

Original Profit Margin Price

$20 ItemPrice

$200 ItemPrice

$2000 ItemPrice

$20000 ItemTen Percent

(Expenses are 90 percent of original cost)19.52 195.20 1952 19520 Twenty Percent

(Expenses are 80 percent of original cost)19.04 190.40 1904 19040

Considering that only highly elevated productivity can enable U.S. corporations to compete with the lower waged producers, cutting prices by 2.5 percent - 5 percent will be insufficient. A potential price cut of 5 percent, exhibited by the more highly profitable, begs the question -- being as profit margins are high, why not cut those margins in the higher tax environment and make the company more competitive?The slight difference in prices due to the corporate tax also answers those who claim the consumer eventually pays for the tax. If there is a price increase to retrieve the tax, it is a relatively small percentage of the original price. In addition, what corporations pay in taxes the public does not have to pay, and the government uses the revenue for public welfare.

Naive citizens have proposed that corporations might use the added profits from lowered taxes to increase labor rates, with a possible amount being 2-5 percent. This is another example of shallow thinking.

(1) Corporate managers learn from economic professors that maximizing profits is the duty of the corporate executive. Profits will always come before wages.

(2) The federal government has a budget, which dictates raising revenue and minimizing deficits. Will not cutting corporate taxes shift the tax burden to the wage earners?As for research and development (R&D), sect;174(a) of the tax code permits a taxpayer to treat (R&D) expenditures as deductible expenses in the current year or as capitalized R&D over a 60 month period. Government also uses taxes for financing R&D, and sometimes much more efficiently and effectively. One company might have millions available for a project; the government accumulates billions for their projects. Ask semiconductor and aircraft company executives how their companies reached tens of billions in annual profits -- decades of government-financed developments, especially in the defense industries.

High tax rates drive corporations to nations that have low tax rates.

Commentators spuriously define the words tax havens, tax deferred, and tax inversions to confuse the public, and promote the mistaken belief that U.S. corporations can change their domicile and easily escape major payments of the corporation's federal taxes on income earned within the United States. Corporations whose sales contain much intellectual property (Microsoft) are able to shift certain profits on sales, but this cannot easily occur for profits earned from trade or business of defined products within the United States. These are subjected to U.S. taxes - nobody, even foreigners can escape that law.

Evasion of U.S. taxes applies to finding means to lower excise taxes, artificially shifting ownership of assets to a foreign subsidiary, deferring profits made by overseas subsidiaries, and finding means to use the deferred profits in the USA (inversions). However, a lower corporate tax rate does not resolve any of these tax evasions. Examine each of them.Tax havens

A U.S. company can transfer its intellectual property rights and become subsidiary to a foreign company, even if the company developed the underlying technology in the United States. The U.S. subsidiary then pays royalties to the foreign subsidiary to use the intellectual property. The payment decreases the profit of the US subsidiary and boosts the profit of the subsidiary, which has a lower corporate tax rate.In another example of avoiding taxes, a subsidiary in a high tax country borrows from a subsidiary in a low tax country and enables the parent company to pay artificially high interest rates to itself. No real business activity transpires, but the company's global tax bill is lower.

A more delicate procedure is to charge expenses from a subsidiary in a low tax company to the books of the high tax subsidiary, if the corporation can get away with this illegal maneuver.

Changing laws and rules and scrutinizing them more carefully are more effective means for preventing these tax evasion schemes. Missing from examination of the alarming subterfuge is that lowering the corporate taxes means the government gains a few billions of dollars from corporations who use tax havens for the above stated purposes and loses tens of billions of dollars in revenue by lowering the taxes. In addition, the profits earned overseas by these types of tax havens cannot be retrieved without the corporation paying the designated tax. They can defer it but how will they use it? These types of tax havens are a genuine detriment to the economy, but the solution involves engaging those who take advantage and ascertaining methods for halting the transgressions. Lowering the corporate tax rate as an effort to retrieve the lost tax revenue may help companies but it harms the U.S. Treasury.

Deferred Taxes

The misconceptions, misperceptions, and misrepresentations of the words deferred tax have confused the public, and the confusion has been intentional. They come from two opposing agendas, one that treats the deferred tax as a corporate conspiracy to avoid paying U.S. taxes and by another, which claims that corporations defer their tax because of the high U.S. corporate tax rate. Neither of these agendas has presented the facts correctly and neither of their conclusions is valid.The U.S. tax code treats earning from U.S. corporations globally -- taxes are due no matter where profits are earned. Taxes owed to the U.S. government are reduced by what the company pays in taxes to the foreign nation in which it earned the profits. As for foreign corporations engaged in a trade or business within the United States, they are taxed at regular U.S. corporate tax rates on income from U.S. sources that are effectively connected with that business, and at 30 percent on U.S.-source income not effectively connected with that business.

The more widely used tax code is the Territorial Tax, which taxes domestic income and not income earned by subsidiaries in a foreign land. Because the U.S. is not aligned with most nations in its tax code, it allows domestic corporations who have earnings outside the United States to defer the tax until it returns the profits to the U.S. If profits are deferred, corporations cannot use the money to pay dividends, buy back stock, or expand plant in the U.S.

The overseas subsidiaries are only following what the U.S. tax authorities allow them -- until they have reason to use the money at home, invest overseas, which usually means keeping the money in a U.S. bank and deferring taxes. If a corporation had need for repatriating the funds, would it not do that, despite the tax? Who would refuse obtaining a 10 percent return at home on 85 percent of the after tax profit, rather than 1.2 percent interest on use of 100 percent of the profit? For some corporations, it is preferable to use these offshore assets as collateral, sell a low interest bond, and raise funds rather than repatriate the overseas profits. Let those who refuse a tax advantage cast the first dollar.

Much confusion arises from the publicity of Apple Computer locating their European (not worldwide) headquarters in Ireland and receiving special tax breaks from an already low tax rate nation. Apple detractors led the public to believe that by doing the move, Apple evaded U.S. taxes. Not so.

Forbes, What America's Biggest Companies Pay In Taxes, APR 18, 2017

by Christopher Helman |…30 outfits with annual revenues greater than $80 billion, all told, in the past 12 months have recorded income tax expenses totaling $117 billion - representing an average effective tax rate of 26.7 percent. The biggest taxpayer was the most profitable: Apple, which reserved $15.8 billion for income taxes on $59 billion in operating income. Apple reports its effective tax rate as 25.8 percent.

No matter where Apple incorporates overseas, it can defer taxes on profits made overseas. Incorporation in Ireland negatively affected the European nations, whose European Union claimed that the deal allowed Apple to pay a maximum tax rate of just 1 percent in a nation whose normal corporate tax rate is 12.5 percent. "Member states cannot give tax benefits to selected companies - this is illegal under EU state aid rules," said the European competition commissioner, Margrethe Vestager. Actually, the tax arrangement is positive for the United States' Treasury; when, and if Apple repatriates the profits, it will pay U.S. tax authorities 34 percent instead of 22.5 percent on its repatriated profits. Why are corporate tax detractors complaining?

The Joint Committee on Taxation estimates that the U.S. Treasury will lose (ED: delay receiving) approximately $50 billion a year because of the deferral of corporate taxes on foreign profit. That sum is meaningful but, if the corporate tax were abolished, the U.S. Treasury would lose about 400 billion dollars annually.

Repatriation of foreign profits, which is an export, benefits the U.S. economy. To achieve the benefit the corporations seek a compelling need. The U.S. method of global taxation -- treating offshore profits the same as domestic profits -- conflicts with the more widespread territorial tax system and creates the problem. Treating them differently might resolve the problem.

Tax Inversions

Similar to deferred taxes, Tax Inversions have been distorted to the public. Portrayed by one agenda as a corporate rip-off and by another agenda as an example of why corporate taxes should be eliminated, Tax Inversions affect the U.S. economy but cannot be resolved to Americans' advantage by lowering or eliminating corporate taxes.

Tax Inversions transfer ownership of a U.S. corporation to a purchased foreign subsidiary, which becomes the parent company's base. Burger King purchased Canadian Based Tim Horton, a doughnut and coffee chain, and soon became a subsidiary of Restaurant Brands International Inc. ("RBI"), with global headquarters in Ontario, Canada. What changed?Burger King is still an American company, headquartered in Florida and all of its U.S. based operations pay the same U.S. corporate taxes. Foreign profits can be used for dividends, stock repurchases, and investment in the United States, without paying taxes on the foreign profits. Tim Horton now has a better opportunity to enter the U.S. market, compete with Dunkin' Donuts, and pay taxes on all profits earned in the U.S. In effect, the tax inversion does what companies have been asking -- change to a territorial tax system. Burger King has done this by changing its global headquarters.

How damaging are Tax Inversions? The Los Angeles Times, Solving the inversion crisis: How the U.S. can keep companies at home, Michael Hiltzik, Dec 4, 2015, says not very much.

Big controversies often arise from big numbers, and on the surface the cost in U.S. tax revenue from the corporate tax avoidance scheme known as "inversion" looks like a big number: potentially $20 billion over 10 years, according to a congressional estimate last year.

However, since the corporate income tax is projected to bring in some $4.5 trillion over the same period, inversions might cost less than half a percent of corporate tax receipts.The fear is that the inversion process can catch steam and advance rapidly in the future. However, this will not stimulate a change in the corporate profit tax rate; the U.S. Treasury will lose more by lowering rates for all domestic corporations than it gains by being able to tax foreign subsidiaries and slowing the inversion process. The U.S. tax authorities will he obliged to find a solution, which will steer them toward adaptation of a Territorial Tax.

There is no evidence that the corporate tax rate has provoked American corporations to move domestic production facilities to foreign shores, or that the corporate tax is responsible for loss of jobs. Wages and productivity govern where to produce and where to sell. Try producing automobiles in the Cayman islands. Despite the tax rates, entrepreneurs prefer the U.S. internal market, where companies can grow and reap profits in a short time. Why else would many of the world's leading multinationals from nations with much lower corporate tax rates have manufacturing plants in South Carolina and Tennessee?

CONCLUSION

Corporate tax antagonists have chased the wrong rate. Rather than assuming lower rates mean higher GDP, they should determine the optimum corporate tax rate, the rate that most benefits the entire economy. This rate considers (1) tax breaks and loopholes dictate a maximum rate that is much higher than the effective rate, (2) corporations owe the government for the financial benefits they receive, (3) changing the rate means changing the personal income tax rate, and, (4) the effectiveness shown in the historical record by the present tax system is a significant factor. After an extensive examination, the tax detectives may learn that the present corporate tax rate, which has not impeded profit growth and benefited the U.S. Treasury, might be optimum.

If it isn't broke, why fix it?

For sure, the Trump administration will push the vase off the shelf, and, after breaking it, show how they can fix it, except the replica will not have the same elegant appearance as the original.alternative insight

august 16, 2017HOME PAGE MAIN PAGE

alternativeinsight@earthlink.net

comments powered by Disqus