Alternative Insight

Government Debt is not the Problem

The economic system generates the problem

As the United States economy proceeds through familiar contortions, government and conventional economists go through similar contortions, reflecting ambiguous, contradictory, and disjointed policies that defy rigorous analysis. Common features: a lack of attention to the limiting factors of the Capitalist system and excessive attention to only patching the problems that cause its periodic crises.Early economists struggled with the meaning of the profit factor and with the procedures for clearing all manufactured goods. Would aggregate demand always equal aggregate supply? Clearing all manufactured goods is a principal element in the economic crises that infect the capitalist system. Profit (surplus value for manufactured goods) plays a decisive role in hindering the clean sweep. Other factors either contribute to economic restraint or compensate for the system's limitations. By gathering all factors into a basic system model, the limitations of the capitalist system can be analyzed and the means to overcome these limitations can be proposed.

In a simple closed economic model, which has no service industry, no trade, and a 'zero' balance in government spending, clearing the sale of all manufactured goods demands purchasing power equal total prices. Insufficient purchasing power restricts production and creates unemployment. Basic equations tell much of what we want to know. The equations:

Price of Manufactured Goods = Gross Manufacturing Wages + Wages in the Cost of Materials and Energy + Profit From all Sources

Purchasing Power = Gross Wages Spent + (Invested Profits + Dividends - Retained Earnings) - Savings (unused)

An Explanation of the Factors:

Gross Wages Spent is all wages spent, and includes taxes and benefits. Taxes contribute to government spending, and will be either invested or will supply additional wages. Benefit payments are either reinvested or contribute to spending by others (health, social security payments to retired). Since taxes and benefits are eventually spent, they are included in the equation. This equation assumes a balanced budget (taxes = spending). Therefore government spending does not affect the equation.

Invested Profits are profits that are reinvested and circulate in the economy.

Dividends are profits issued to stockholders and which enable purchasing power.

Retained Earnings remain as cash in the company's books.

Savings in this equation is defined as unused income plus speculative transactions plus bank reserves that don't circulate as investments or loans.In this model, if a portion of wages are saved and are neither invested nor spent, or if any profits are retained, then purchasing power cannot equal the total value of all manufactured goods. Since some wages are always saved and not spent, and growing enterprises need retained earnings to prepare for a downturn, the free enterprise system suffers periodic downfalls. The next step: Add credit to stimulate spending.

Purchasing Power = Gross Manufacturing Wages + (Invested Profits+ Dividend - Retained Earnings) - Savings + Domestic CreditCredit is generally accepted as equal to total savings that are invested. The investment derived from private borrowing offsets insufficient purchasing power. However, if the economic system grows too slowly, existing payments of principal and interest inhibit additional credit expansion. If growth from other contributing factors does not offset credit stagnation, purchasing power will eventually reach a limit. Inflation slows this limit, but inflation also has limits. Without credit, the free enterprise system grows at a slow pace and suffers more frequent calamities. Without inflation, credit limitations will occur at lower GDP levels.

Government deficits to the rescue.

As domestic credit slows down, government deficits replace the decreasing credit. The equation becomes:Purchasing Power = Gross Manufacturing Wages + (Invested Profits+ Dividend - Retained Earnings) - Savings + Credit - Government Account

Government Account is net state and federal government income and expenditures. When a government budget chooses deficits, the negative account adds to purchasing power. A positive account subtracts from purchasing power.Without government targeted spending and its deficits, the economy would have ground to a halt in a past decade. Public spending created significant infrastructures of roads, rail and airports. The electronics, airlines and other industries owe their existence to defense spending. The Eisenhower administration construction of an interstate highway system allowed the automobile industry to grow and expand.

Credit expansion and government deficits enable a closed free enterprise system to function for a long period of time. Nevertheless, a closed free enterprise system cannot survive forever. Opening the economic system to foreign trade is what the free enterprise system is all about, and was from the beginning when it was known as mercantilism capitalism. Add the current account to the equation, and we have the final equation:

Purchasing Power = Gross Mfg Wages + (Invested Profits+ Dividends - Retained Earnings) - Savings + Credit + Current Acct - Government Acct

Current Account is the sum of the trade balance (exports minus imports of goods and services), net factor income (interest and dividends) and net transfer payments (such as foreign aid). If positive, it adds purchasing power to the economy. Since the current account has been in deficit for decades, it has been a subtractive figure and has transferred purchasing power out of the economy.

Still ignoring the service industry, the equation restates the familiar identity:

Domestic Private Balance + Foreign Balance + Domestic Government Balance = Zero

To obtain the identity,

Domestic Private Balance = Purchasing Power - ((Gross Wages + (Invested Profits + Dividends - Retained Earnings) - Savings + Credit))

Foreign Balance is negative of Current Account

Government Balance is Government Account

Note that if the Current Account becomes more negative (Foreign Balance more positive) either the Government Account must become more negative (increased deficits) or the Domestic Balance must become more negative (Credit increases).The Service Industry

Money which circulates from the production economy to the service economy is eventually used to purchase goods. If the funds continue to circulate in the service economy, they provide additional service jobs until spent on goods. The service economy increases GDP, but, except for some cases of ambiguous definition, it does not by itself add purchasing power for manufactured goods. Although this concept requires extensive discussion, a brief example explains the statement.

Purchasing a service, such as medical, transfers purchasing power from a production worker to services. The medical practitioner who receives the funds can purchase either another service or goods. If it is the latter, then the original funds are transferred back to the goods economy. No new purchasing funds have been generated.

The Service Economy creates infrastructure (buildings, warehouses, distribution) for its operations, but, except for some rare activities (arts, tourism) does not create material wealth. It is difficult to borrow funds to obtain a personal service or use a personal service as collateral. Being as service imports and exports affect the available Current Account statistics, they are included in the current account factor.

What is noticeable?

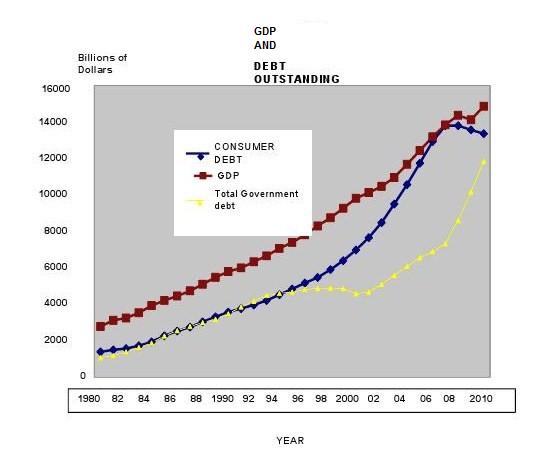

If non-invested profits are included in sale of goods, then wages cannot purchase all goods. Even if all profits are reinvested in capital purchases and distributed as dividends, the lag time between new purchasing power entering the economy and sales price of all goods creates difficulties in clearing the market. Other factors add to the dilemma.Retained earnings in an expanding economy, dormant savings (which is usually small), and the constant circulation of speculative money in stock and commodity markets (which can be large), reduce purchasing power. Private, consumer and public credit overcome the reductions and enable the economy to advance. Without the phantom purchasing power of sufficient credit, the economy quickly fails. Enormous private credit allowed the Clinton administration to achieve a government surplus. Constantly increasing credit enabled GDP growths during the Reagan and Bush Jr. administrations. However, in order to repay the debts, the economy and wages must grow. Unless these occur, credit outstanding reaches a limit and when that happens, the economy stalls. The accompanying graph, whose sources are: US Federal Reserve, BEA, and US Bureau of the Census, includes the service economy and describes these relationships.

GDP grows proportionally to the growth of the sum of consumer and government debt. Once issued, the monetary equivalent created by debt continually flows through the service economy or to the goods manufacturer. When debt retirement exceeds new debt issuance, the money supply is decreased.Note that a rapid growth in consumer debt during the Clinton administration, permitted a decrease in government debt. The boost in private debt (a positive to purchasing power) overcame the government surplus (a negative to purchasing power) and allowed a rise in GDP. When private debt decreased during the post 2008 recession, an extra stimulus of government debt prevented a rapid fall in GDP and eventually enabled the GDP to rise.

The graph reveals the free enterprise system as a free money system, whose growth depends mostly on consumer and government debt and less on reinvestment of earnings.

We now come to the important component of the system, the current account balance. If it is negative, which it has been for 25 years, purchasing power leaves the economic system and, unless supported by other means, will eventually lead to an economic decline. The success of mercantilism capitalism, a nationalist-oriented form of early capitalism that used the state to advance national business interests abroad, demonstrated that the wealth of a nation is increased through a positive balance of trade with other nations. Capitalism flourishes with a positive current account balance.To maintain equilibrium in the global system, creditor nations purchase debt from debtor nations. Increases in government deficits, as part of a stimulus plan that offset the lack of private investment, required this additional foreign investment.

Current account deficits have been, and still are huge. Averaging about 500 billion dollars per year from 1997 to 2007 (before recession), the exit of purchasing power required a debt increase of equal dollars to compensate for the loss. This value is about one-half the total increase in debt (sum of consumer and government) during the same period. The current account deficit does not control spending as much as consumer debt, but does exercise some control of the national deficit. Creditor nations circulate dollar reserves to purchase low risk U.S. government treasury bills and bonds. The deficit funds circulate in the economy and are often used to purchase exports from the creditor nations.

The Accounts graph, Source: wikipedia.org/wiki/United_States_public_debt

describes the growth of the current account deficit and the external debt.

Repayment of the latter is more difficult and complex than repayment of internal debt.

Current account balance and debt

Unless the current account deficit is reduced, government deficits can only be greatly reduced by inflation. Unless the current account becomes positive, profits must be financed by debt. Although inflation can reduce external debt, inflation has negative consequences. The only harmless manner to repay external debt is by a positive current account.

External debt and its interest cannot be repaid from domestic sources without disturbances to the economy. Repaying external debt by shifting external debt to internal debt forces funds to leave the nation and decreases aggregate domestic demand for goods. Diminishinging external debt by selling domestic assets to foreign sources downsizes the nation.

Internal debt, such as occurred after World War II, stimulated the economy when the government repaid the War Bonds. External debt operates in reverse; repaying the debt subdues the economy and slows dollar depreciation. Although depreciation of the dollar against all currencies restricts imports and encourages exports, a decrease in import quantities does not guarantee a fall in import sales. Several commodities and consumer goods have become necessities and are not easily replaced by domestic manufacture. Increased import prices might offset the volume decrease and prove more damaging. Outsourcing adds to the problem.

Lack of attention to out-sourcing and the consequences of extensive credit for financing imports have deteriorated the U.S. economic system. The loose credit policies of Presidents Reagan and Bush Jr. played a significant role in the 'boom to decline,' and the current account deficits reflect the decline. To accomplish a positive current account balance, either exports must be greatly increased and/or imports must be reduced. Energy savings will assist the occurrence of the latter, but new industries that compete with imports need to be established and expanded. Nevertheless, the mechanism of the global economy hinders the task of bringing the U.S. economy to a positive order; as imports are decreased the purchasing powers of other nations are also decreased, which slows U.S. exports.

The analysis reveals that 'run away' free enterprise has a short life. As, in an earthquake, gradual movements over time are followed by small shocks and have recession effects. Sharp movements lead to great shocks and the system survives by wiping away debt through bankruptcies and inflation. Easy money promoted advances in building industries and construction of huge housing and office complexes. The complexes still exist, barren in many cases, while banks, mortgage lenders and individuals have gone bankrupt.The table below lists the short and many lives of the free enterprises system.

Dates and durations are from the official chronology of the National Bureau of Economic Research. From Wikipedia:

"The National Bureau of Economic Research dates recessions on a monthly basis back to 1854; according to their chronology, from 1854 to 1919, there were 16 cycles. The average recession lasted 22 months, and the average expansion 27. From 1919 to 1945, there were 6 cycles; recessions lasted an average 18 months and expansions for 35. From 1945 to 2001, and 10 cycles, recessions lasted an average 10 months and expansions an average of 57 months."

Name Duration Time since previous recession Great Depression 4 years 7 months 1 year 9 months Recession of 1937 1 year 1 month 4 years 2 months Recession of 1945 8 months 6 years 8 months Recession of 1949 11 months 3 years 1 month Recession of 1953 10 months 3 years 9 months Recession of 1958 8 months 3 years 3 months Recession of 1960–61 10 months 2 years Recession of 1969–70 11 months 8 years 10 months 1973–75 recession 1 year 4 months 3 years 1980 recession 6 months 4 years 10 months Early 1980s recession 1 year 4 months 1 year Early 1990s recession 8 months 7 years 8 months Early 2000s recession 8 months 10 years Great Recession 1 year 6 months 6 years 1 month Government debt is not the problem. A system that exists by debt is the problem.

Capitalism, or the free enterprise system as it is now called, has failed many times, only to start anew. Economic theories, mathematically derived equations, volumes of books, articles, and discussions have failed to supply sufficient knowledge to halt the cycles of boom and recession. Nor has it been made clear why the economy recovers. If an analysis had clarified the mechanisms that guide the economy, arguments to its workings would not exist, and applications of control would be appropriately applied.

Government deficit is one of several methods to increase the money supply and create demand. Without public deficits, the economy would have faltered several times. In the last decades, where government deficits have greatly increased, recessions have become less frequent. One reason is because in times of economic stress, government borrowing exhibits advantages.

(1) Government borrows at much lower interest rates than consumers and its debt can be easily rolled over. The average interest rate for government securities fell from 5.05 percent in June 2007 to 3.55 percent in April 2009, which allowed the accumulated interest to actually decrease from $377 billion for the first six months of year 2008 to $321 for the first six months of the year 2009.

(2) A significant portion of the $11 trillion public debt (year 2009) is self-owned. About four trillion dollars of the debt are intergovernmental IOU's, which are mainly trust funds, such as social security. It is uncertain that the government is legally responsible to honor these loans. Although the commitments will be met by tax revenue, it is doubtful the loans will ever be repaid. If this is true then the government 2009 debt reduces to seven trillion dollars.

(3) Low interest and short term loans, which are easily rolled over, constitute much of the government debt. In March 2009, the marketable public debt was $5.759 trillion. Less than one year maturity = $2.601 trillion. One to five year maturities = $1.709 trillion and 5-10 year maturities = $0.833 trillion.

The U.S. economic system no longer has free land to occupy, slave labor to utilize, mass immigration to supply a cheap working force, global resources to seize, and markets for the taking. Success in the global economy requires a positive balance of payments, and those who obtain the positive balance - China, Korea, The Netherlands, Switzerland, Germany, Southeast Asia, Gulf nations and Saudi Arabia - have retained stability in the face of a global recession. The road to a positive current account is not the impossibility that hasty judgment concludes. If the United States can go from a debtor nation to a creditor nation with about $200 billion annual current account surplus, it can rapidly increase its reserves and repay a sizable portion of external debt within ten years. Advances in the domestic economy will increase tax revenues and permit domestic lenders to rewrite the remaining external debt.As a starter, U.S. manufacturers should explain why Germany, with manufacturing labor rates 50% higher than those of the United States, as shown by US Bureau of Labor statistics (~ $25/hr for US Mfg workers) and European Union statistics (~$40/hr for German workers), and a population only 20% that of America, exports more automobiles and other merchandise products than U.S. manufacturers. The year 2011 has the U.S. third in the world with merchandise exports, while Germany and China shift between first and second. Considering U.S. resource and mineral wealth, and its extensive transportation, communication, advertising and marketing systems, the U.S. has advantages that should enable it to lead in merchandise exports. U.S. multinational corporations benefit from America's advantages, but don't use these advantages to benefit Americans.

U.S. multinational corporations, of which Apple is an example, send dollars overseas by importing much more than they export to affiliates ($50 billion in 2006) and non-affiliates ($98 billion in 2006). These corporations add some tax revenues to the U.S. Treasury, but they slowly drain purchasing power for domestic production by supplying merchandise for which there is no domestic replacement. U.S. consumer purchases of the foreign made products of domestic multi-national corporations profit these corporations and their foreign workers.

Apple Computer's manufacture of one of its IPods indicates how it is possible to transfer overseas value added back to the United States. One particular IPod had a sales price of $299, of which $80 was Apple's profit, and $144 was manufacturing cost; almost all by overseas suppliers. Marketing, distribution and sales profit added to the final price. If Apple replaced either a display module ($20) or the hard memory ($53) by domestic manufacture, then an equivalent drop in imports would occur. Detailed examination of Apple's costs and those of other overseas manufacturers reveal that the differences between using domestic rather than foreign manufacture might only reflect a few less dollars in profits or a few more dollars in price. Lowering profit or increasing prices, the latter being a competition decision, will accommodate domestic labor, lower the trade deficit, and add purchasing power to the domestic economy.

It's a citizens' problem

U.S. citizens denied themselves consumer goods during World War II and didn't suffer consequences; just the opposite, despite huge government deficits, the economy recovered quickly and raced forwards. Although urgencies of the economic downfall are less severe than those of World War II, the sacrifices to resolve these urgencies are equally severe. Several years of denial of imports and dedicated reconstruction to rebuild export industries under government supervision will bring decades of prosperity. Cooperating with the government, rather than countering it, is again a requirement for winning the economic war. By understanding the principal drivers of the economy, the ability to rescue it takes shape.

Credit expansion and trade balance mostly determine the economy. Innovation, tax policies, fiscal policies, Federal Reserve operations, and a host of other supposed expansionary theories are subordinate to the dominating factors. When the balance of payments goes negative, deficits must increase. Knowing that a lack of credit expansion shrank private spending, the government increased public spending as a substitute for decreased private spending.and salvaged the economy. The public spending, which filtered through the economy, and the government's rescue of several corporations are responsible for new job creation. Just to say: "We must cut the deficit," without knowing its consequence aggravates the situation. As an example, defense appropriations aren't entirely for the defense of the nation. The defense budget is a giant 'make work' project that serves to create industries and employ a mass of workers. Private industry creates jobs when the finances and consumers are available. In the over-leveraged economy, government deficits are a principal means for job creation. Good enough, but there is one better route! Current account surpluses stimulate job creation and repay public deficits. Which method is preferred for job creation?alternativeinsight

july 20, 2011HOME PAGE MAIN PAGE

alternativeinsight@earthlink.net