Alternative Insight

Government Debt and Resolving the Economic Crisis

Resolving an economic crisis is not a walk around the block. It's more like a landing on the moon. Figure out what will work and then hope you are not wrong.Private industry's 'profit above all entrepreneurs' of the George W. Bush administration days must take blame for the crisis. Their economists did nothing to predict or forestall the downfall. And now, they are neither examining the causes, the problems and the issues confronting the crisis, nor proposing innovative methods for reversing the downfall; just the usual slogan: "We think the economy will come back because Americans are hard-working and this is the best economy the world has ever seen" - no facts, no reasons, no analysis, just words. We also receive contradictory reasons for the continuous recession: "Americans are not spending enough" and "Americans are not saving enough." Before opposing the present administration's aggressive policies, the 'free loading' free marketers should be providing answers to basic questions.

What is the significance of the debt?'

How much debt can the American economy afford?

Can the debt be repaid?

What does all this mean?What is the significance of the debt?

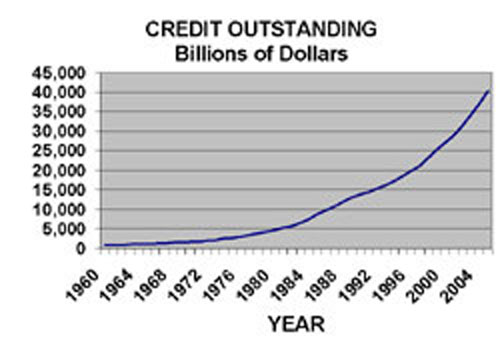

(1) The United States economy, rather than being a free market economy, has been a free money economy, which progressed primarily by credit. The accompanying graph shows that the Gross Domestic Product (GDP)

and credit track each other closely.

(2) All of the nation's citizens (consumers, institutions, corporations, businesses) are responsible for the public debt, which can only be repaid by taxes; although asset sales, inflation and forfeiture are other possibilities for reducing debt. The government debt has a different mix of long and short term loans, is more easily rolled over, and carries lower interest rates. Nevertheless, the more publicized but less personally obtrusive public debt should be considered as a part of each citizen's debt.

(3) Credit has a multiplying factor; each dollar invested gets multiplied through the economy. As a rough example, if someone borrows funds and purchases a service, the service recipient might use the same funds to purchase another service and so forth. One spent dollar can mean several dollars of increase in GDP, which is the sum of spending for goods and services.

(4) Purchasing power for domestic goods contains the sum of payrolls, foreign remittances, foreign sales less imports, dividends and credit. The latter increase in debt provides profits and growth. A dollar spent on imports is a dollar unavailable for spending on domestic production

Conclusions:

(1) The credit outstanding consists of the sum of government debt, consumer debt, mortgage debt, financing debt and business debt. In June 2009, the Federal Reserve calculated this debt to be $52 trillion.

.(2) Huge deficits in trade balance ($900 billion for the U.S. at the start of the economic decline) mean huge losses in purchasing power for domestic goods and services.

(3) If any of the purchasing power factors decrease, then in order to sustain the economy, one of the other factors must increase. Since private debt hit a wall, then either the deficit in trade balance must decrease (this has happened) or public debt must increase to offset the private debt reduction. This has also happened.

(4) As credit declines, the multiplying factor works in reverse. The economy can decline rapidly with the service industry degrading most severely.

How much debt is there and how much can the American economy afford?

(1) The government borrows at much lower interest rates than consumers and its debt can be easily rolled over.The average interest rate for government securities fell from 5.05 percent in June 2007 to 3.55 percent in April 2009, which allowed the interest expense to decrease from $377 billion for the first six months of year 2008 to $321 for the first six months of the year 2009.

(2) A significant portion of the year 2009 $11 trillion public debt is self-owned.

About four trillion dollars of the debt are intergovernmental IOU's, which are mainly trust funds, such as social security. It is uncertain that the government is legally responsible to honor these loans. Although the commitments will be met by tax revenue, it is doubtful the loans will ever be repaid. If this is true then the government 209 debt reduces to seven trillion dollars.

(3) Low interest and short term loans, which are easily rolled over, constitute much of the government debt. In March 2009, the marketable public debt was $5.759 trillion. Less than one year maturity = $2.601 trillion. One to five year maturities = $1.709 trillion and 5-10 year maturities = $0.833 trillion.

(4) In June 2009, consumer loans = $2.519 trillion and mortgages = $11.013 trillion. Total private debt was much higher than public debt ($7 trillion).

(5) Trade (goods and services) statistic comparisons with past years from Jan-May show remarkable improvements:

YEAR

Jan.-MayEXPORTS

billions dollarsIMPORTS

billions dollarsDEFICIT

billions dollars2007 651 948 297 2008 763 1068 305 2009 620 766 146 http://www.census.gov/foreign-trade/Press-Release/current_press_release/exh1.txt

(6) Total debt in the economy has been calculated at $52.859 trillion. Comparison with 1974 reveals an excessive financial industry role (leveraging) in overall debt increase..

YEAR TOTAL ($Trillion) Total Household Total Business Total State & Local Total Federal Total Financial Total Foreign 1974 2.408 0.680 0.823 0.208 0.358 0.258 0.081 Q1 2009 52.859 13.795 11.156 2.259 6.721 17.021 1.907 http://www.federalreserve.gov/releases/z1/Current/z1r-2.pdf

Conclusions:

(1) The decrease in imports reflects the decrease in consumer borrowing. Credit has financed imports. Note that exports have not greatly decreased. Although the trade deficit is still high (statistics are only from five months of the year) the trend is in a beneficial direction.

(2) Much of the trade deficit is due to petroleum imports, $71 billion for the first five months of 2009. The government spending for new energy sources promotes wind and solar power, both of which affect coal usage for electrical production rather than petroleum usage for automobile fuel.The thrust of the increased government spending for energy conservation will benefit the economy but investment in petroleum replacement might be a more optimum approach.The statistics seem to indicate that a strong dollar will lower the cost of all imports without drastically affecting exports. Any attempt to depreciate the dollar might be counter productive to economic recovery.

(3) Without credit expansion, private spending shrinks and the economy declines. The government has salvaged the economy by increasing the budget, which substitutes public spending for decreased private spending. The expected increase in government debt of $1 trillion is not too overpowering when we consider that the present $7 trillion public debt is only a fraction of the overall $53 trillion credit outstanding and government debt is easily rolled over. The Federal Reserve's capability to maintain interest rates enhances the effectiveness of budget expansion.

(4) Household debt has increased proportionally to total debt since 1974, while the proportions of business and federal debts have slightly declined. However, financial industry debt has increased dramatically (this has happened during the last ten years) and dwarfs other debts. Much of this increase might be double bookkeeping, but its growth dramatizes the elevated leveraging that undoubtedly financed the 'boom' years. Financial debt now seems to be a major problem.

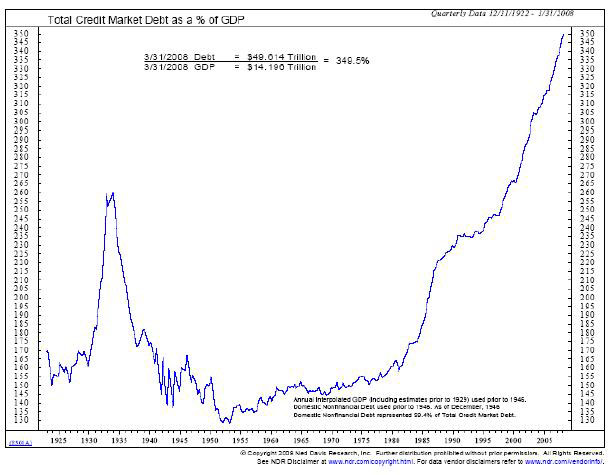

(5) The ratio commonly used to determine excessive government debt, which is debt to GDP, is dubious. Other factors must be considered. If credit retreats, the GDP will shrink and government debt, without actually increasing, will become a greater ratio to the GDP. Additional public deficits will augment the ratio (now about 0.5) The private debt to GDP ratio is a much higher ratio (almost 4.0) and more significant.

(6) Although its implications are not clear, a graph depicting the growth in the ratio of total debt to GDP (http://www.thedelphicfuture.org/2008/08/credit-m4-vs-gdp.html) deserves attention. After the start of the great depression, as the GDP decreased, the debt ratio increased, and with the new Roosevelt administration, the GDP started to increase and the debt ratio decreased.

The graphs seem to indicate that economic recovery is not complete until the debt to GDP ratio falls appreciably from a high level so that renewed growth can sustain more credit. Considering the huge credit expansion since 1950, coupled with an ever increasing debt to GDP ratio, the recession has a way to go before the economic forces allow an acceptable debt to GDP ratio.

Can the debt be repaid?

(1) The public debt, except for a few years during President Clinton's administration, has only been repaid by inflation, and for good reason: The deficits stimulate economic growth, especially in the defense industry. The preferred manner to reduce the federal deficit is by reducing the government budget, which means reducing the government payroll. Who is willing to do that? Jimmy Carter was willing to at least freeze the budget and he was punished.(2) Government deficits are one part of the overall credit mix that has spurred GDP growth. The dependence of GDP growth on credit is the problem. Government deficits feed the dependence.

(3) Lower interest rates on treasury bills, which are the principal financing of daily government operations has assisted in reducing the deficit. Question: How long can that continue?

(4) Increased taxes can be used to redeem treasury notes, which essentially transfers revenue from consumers to investors. The investors then have funds to stimulate the economy by their private investments. This process can be GDP neutral, which means it can add to the GDP if the investment stimulates spending by an amount equal to that lost by the lowered consumer spending. If an increased tax burden results in an increased positive investment, as described, the added benefit of public debt reduction is worth the higher taxes.

(5) Excessive debt to foreign creditors, such as China, is a danger to the economy because it must be repaid one day and and can't be forfeited. Excessive foreign debt jeopardizes the worth of the dollar, which translates into higher import and petroleum prices. Repayment is identical to an import. Stimulating exports is the preferred method to diminish the foreign debt. Sales of domestic assets to foreign creditors is another method.

(7) Private debt can be slowly repaid. With debt reduction comes decreased demand, a creeping recession, and deflation. Unfortunately much of private debt also disappears by bankruptcies.

(8) The Financial industry debt is mainly reduced by deleveraging - the selling of assets - a spiraling process that lowers the asset prices and requires more deleveraging.

What does all this tell us?

The George Walker Bush administration went all out with credit expansion to invigorate the economy. Sub-prime loans were not the only cause of the economic decline. These loans were made to the borrowers of last resort; the ultimate debtors for continuing economic growth. In addition record government deficits added to the exorbitant spending. After these credit arrangements, no more borrowers were available and thus came the deluge.The huge federal deficits, entirely unnecessary during economic expansion, has complicated the use of government stimulus during recession. G.W.Bush is responsible for taking the U.S. towards economic catastrophe and then complicating the tools for recovery.

The government's rescue of 'too big to fail' banks and insurers signified that the financial structure of the nation depended on only few institutions. The economic system had a delicate structure with single-point failures. Who would cross that bridge?

The lack of response of the private sector to the economic crisis forced the government to intervene and pump the economy with debt and deficits. The obvious alternative would have been total collapse, or as Federal Reserve Chairman Ben Bernanke has stated, "A second Great Depression."

A proper criticism is whether the spending is correctly directed. Doesn't spending need to consider revitalization of export industries and support to energy sources that replace automobile fuels?

What seems probable is:

(1) Retirement of present debt will still not allow sufficient credit in the future (2-3 years) to permit the economy to regain its previous position. Since credit growth will be more restricted, it is doubtful economic growth will be strong.

(2) The economic structure will be modified so that it is less credit dependent and more savings dependent.

(3) The government will participate in some vital industries for several reasons: to stabilize the industries, make certain they are adequately financed, and give itself earning power to support programs.

(4) Regardless of the shrieks and cries, some socialization of the economy is on its way. This is neither good or bad - only realistic - without this condition it will be impossible for the USA to compete with the quasi-socialized nations of the world.alternative insight

august, 2009HOME PAGE MAIN PAGE

alternativeinsight@earthlink.net comments powered by Disqus