Alternative Insight

Demystifying the Mystery of Debt

Agendas and mindsets drive the meaning, direction, and consequences of debt. Subjected to misnterpretations, speculative fantasies, and wild rumors, commonplace debt, which has a leading role in advancing Capitalism, is shaped as the Dark Destroyer, an economic nuclear bomb, gathering force and prepared to destroy the financial system.

Providing answers to a few questions enables improved understanding of debt, of how it shapes the economic system, and the magnitude of its perceived problem.

(1) Is all money debt?

(2) How is the debt much larger than the money supply?

(3) Is the present $71 trillion debt sustainable?

(4) Does debt drive the economy?

(5) Is profit subsidized by debt?

(6) Will debt load destroy the economy?

(7) Is credit in wrong hands?

Is all money debt?

The Federal Reserve defines the monetary system as the sum of currency in circulation (M1) and deposits held by banks and other depository institutions (financial institutions that obtain their funds mainly through deposits from the public, such as commercial banks, savings and loan associations, savings banks, and credit unions) in their accounts at the Federal Reserve (M2).

As of June 20, 2019, the monetary system was $14.771 trillion, of which $3.824 trillion was currency in circulation. Within the $14.771 trillion is $3.8 trillion of funds on the Federal Reserve Balance sheet, which entered the economy during the Fed's program of quantitative easing – purchases of government bonds. Debt, reflected as assets in the Fed's Balance Sheet, does not have to be reduced in any prescribed amount or time, unlike the other trillions in the money supply, which reflects the borrowing from banking institutions that created the money and has specific repayment amounts and schedules.

Not all money is conventioal debt, but that which is debt plays a major part in sputtering and advancing the economy. As this debt plus interest is retired, new debt must replace it or the monetary base will decrease and money available for purchase of goods and services will decline. Deflation may occur. It is also possible that rapid expansion of the money supply, if not matched by equal production of goods and services, will produce inflation. Although, pundits predicted this would occur by the Fed's quantitative easing, this has not happened. The preferred explanation is that the money has not circulated and has contributed to asset inflation, especially in the stock market, swollen bank reserves, and other investments, in response to the Fed's quantitative easing, which maintained low interest rates. For the economy to expand, it seems the money supply must expand, and debt plays a role in this expansion. More on this later.

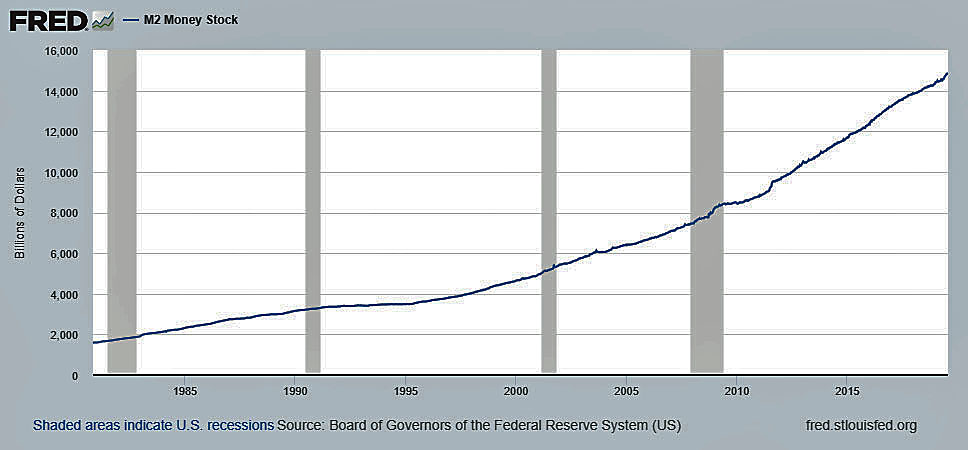

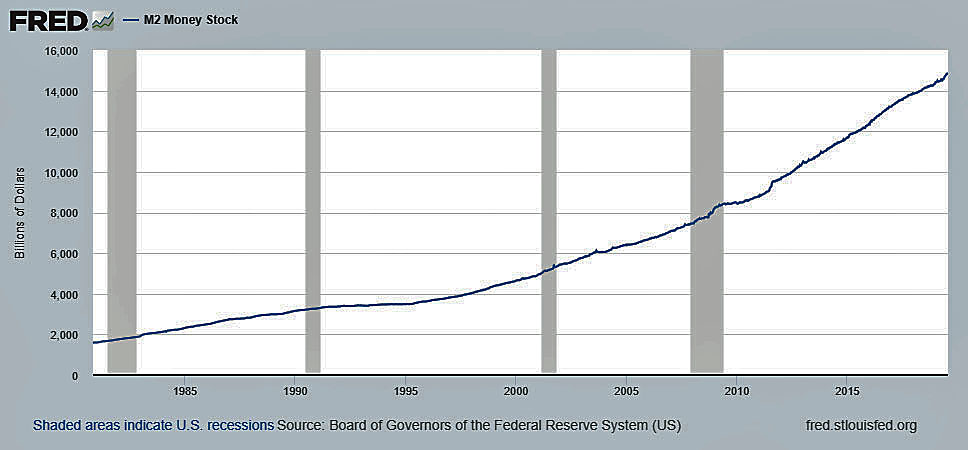

Growth of the money stock, which follows growth of the Gross Domestic Product (GDP), is shown in the following chart.

How is the debt much larger than the money supply?

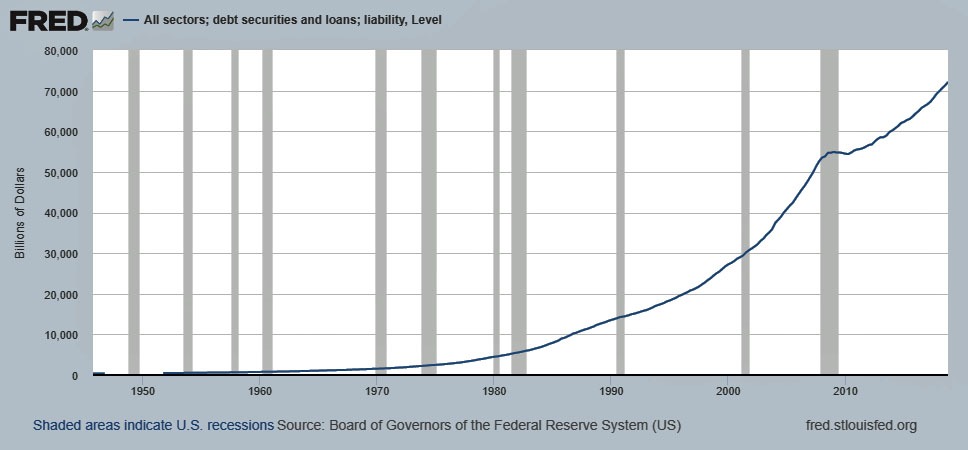

The total debt outstanding in the United States (US), public and private, reached $71trillion in 2019. Note that the first sharp increase in the debt curve occurred during the Reagan administration.

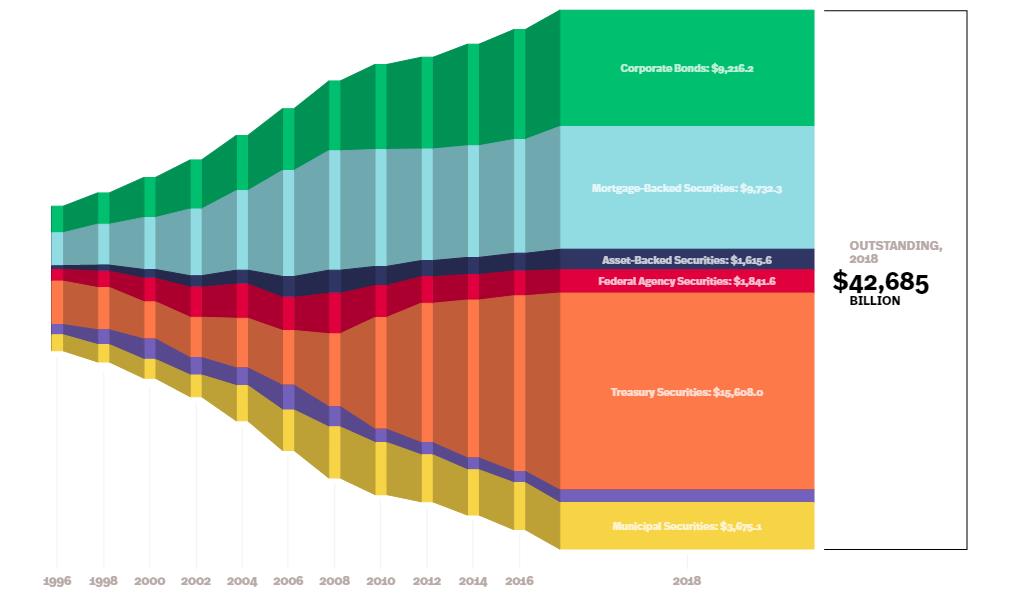

From where does the money come to finance this exorbitant debt? Features of this debt resolve the mystery. The next figure shows that $43 trillion of the debt comes from decades of bond sales. Unlike monetary base debt, this debt does not create new money, does not retire money when repaid, and does not modify purchasing power.

Securities debt, handled by a shadow banking system that is unregulated and operates independent of the depositary institutions, arises when a portion of the money supply is used to purchase bonds. The recipient of the sale uses the funds and immediately recirculates the money in the money supply. Rather than generating new money, this debt only transfers old money throughout the system. Even if the debt is not repaid, the money supply is not affected – the money is in the system in somebody’s hands; unfortunately not in the hands of those who financed the bonds; they have lost a sum but the economic system retains that sum.

The remainder of the total debt outstanding consists of financial instruments — student loans, money markets, private financing, Government-Sponsored Enterprises (GSE) and others. It also includes the money supply debt, which is mostly mortgages and consumer financing.

Is the present $71trillion debt sustainable?

Except for a slight decrease during the 2008-2010 recession, the debt has monotonically increased in eras of high and low interest rates. Undoubtedly, it will hit a wall one day and pause for a breath. Due to its nature, the multi-trillion dollar debt that is not in the money supply is not as onerous as its level indicates. Only a small portion (10-20 percent) must be repaid annually. As mentioned previously, this debt does not add to the money supply and does not reduce the money supply whether repaid or not repaid. Lack of repayment is not catastrophic and will only be important if it becomes excessive and grossly affects investment or cascades into additional forfeitures that reach the depositary banking system. Alertness to overleveraging and involvement of the traditional banks with the shadow banks are appropriate measures to keep the evolving debt sustainable.

Does debt drive the economy?

Given a fixed money supply to purchase goods and services, how can the production and eventual sales of goods and services advance without increases to the money supply? Increase in the velocity of money, which occurred with on-time inventory, credit card purchasing, and computer speedup of financial transactions that included bank transfers, exploded the GDP during past decades. Productivity increases that augmented production and lowered prices elevated the standard of living. A positive or less negative trade balance can also raise the GDP. If these phenomena are not occurring, increases in the money supply by debt are required to increase production and sale of additional goods and services.

The debt also includes the interest, which must be paid out of the available money supply. Even if the economy remained stagnant, the money supply and debt will continually increase; loans to replace the interest on the interest are necessary to maintain the economy or the money supply will shrink, not much but slightly.

Is profit subsidized by debt?

Manufacturers may invest the profit in new production, distribute dividends, pay off loans, give bonuses, or bank as retained earnings. When the entrepreneur uses the added profits to increase production, the cost of those goods absorbs the profit. The entrepreneur's vision is that the new production will generate additional profit. In order to gain this additional profit from selling added goods or services, demand must increase and the money supply must expand. This leads to the question. "Is someone’s profit due to the acquisition of debt by someone else?" Is all profit subsidized by debt?

Will debt load destroy the economy?

Debt, even at much lower figures, has constantly anguished the public. Nevertheless, it grows and grows and nothing catastrophic occurs. The debt, which does not influence the money supply, as previously explained, is not ready to explode the financial system. The money supply, which is not entirely but mostly accumulated debt, is the more essential debt that has the power to disturb the economy, not mainly if it becomes too large but because it may not get replaced and may become too small. Debt drives the economy, and, therefore lack of sufficient debt will undermine the economy.

The preferred manner to manage the money supply (debt) is to have it grow slowly, so that interest rates are kept low, credit is always available, and repayment is easier. This means the economy will also grow slowly, say 2% annually. Which is more preferable, a sustainable and slow growing economy that is almost recession proof or a fast growing economy (4% annually) that every 8-10 years goes into recession? The Obama administration proceeded with the former approach and achieved low unemployment and advancing prosperity.

Is the issuance of credit and its money creation in the wrong hands?

Banks earn more by lending more. Higher interest rates add to their earnings. They produce credit "out of thin air" and receive compensation from the public for a process that is a gift to them. Their duty gravitates to their shareholders and not to the public. Attentions to bottom lines do not recognize effects on the economy.

Is it logical that the public extends the privilege of issuing money to a few that then earn from those who extended the privilege when the public can keep the privilege and earnings to itself? Must the public be constantly subjected to financial calamities due to the greed and incompetence of the private banking establishment?

A maturing US economy, with less emphasis on material goods and more emphasis on sustainability, may demand tight control on credit, the issuer of money and, composition of the money supply. Private Banks may prove to be less able to cope with the new financial environment; the issuance of credit, and money creation.

Establishment of a national bank that is more able to regulate credit, provide lowest interest loans (zero interest, 20 year mortgages are available in Denmark) and respond to dynamic economic changes might receive consideration. This bank will print and issue money in response to the demands of the economy and, by taxation, retire money when inflation occurs. During times of economic contraction, the government will also be able to more easily stimulate the economy and enhance employment by awarding contracts for infrastructure and other projects without turning to the financial markets or interfering with tax revenues.

Conclusions

(1) Not all money is conventional debt. In August, 2019, a total of $3.8 trillion that is not conventional debt, circulated in the money supply

(2) Because the major portion of the total debt does not add, subtract, or affect the money supply, and circulates freely in the economy, the massive debt, as of August 2019, does not seem to be a threat to the banking system.

(3) .Profits have a direct relation to debt.

(4) With all auxilliary factors to growth stagnant, the economy cannot grow without an increase in the money supply and debt.

(5) A shift from a private banking system to a public banking system is a possibility.

"Running into debt isn’t so bad. It's running into creditors that hurts."- Unknown

alternativeinsight

august 12, 2019

HOME PAGE DOMESTIC POLICY

![]()

![]()

alternativeinsight@earthlink.net